iowa city homestead tax credit

54-028a 090721 IOWA. Dubuque County Courthouse 720 Central Avenue PO Box 5001 Dubuque IA 52004-5001 Phone.

Cedar Rapids Iowa City Icr Stats Data Economic Alliance

This application must be filed or postmarkedto your city or county.

. Homestead Tax Credit Iowa Code Section 42515. 701801425 Homestead tax credit. This application must be filed or postmarkedto your city or county.

Application for Homestead Tax Credit IDR 54-028 111014 This application must be. Once a person qualifies the credit continues until the property is sold or. 54-028a 090721 IOWA.

To be eligible a homeowner must occupy the homestead any. No homestead tax credit shall be allowed unless the first application for homestead tax credit is. The Sioux City Assessors Office in response to the COVID-19 virus and the safety of both the general public and our staff has made applications available online for the following.

This application must be filed or postmarkedto your city or county. Iowa Code chapter 425 and Iowa Administrative Code rule 701 801. 8011 Application for credit.

It is the property owners responsibility to apply for. To be eligible a homeowner must occupy the homestead any 6 months out of the year. 52240 The Homestead Credit is available to all homeowners who own and occupy the.

File new applications for homestead tax credit with the Assessor on or before July 1 of the year the credit is claimed. 54-028a 090721 IOWA. Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801.

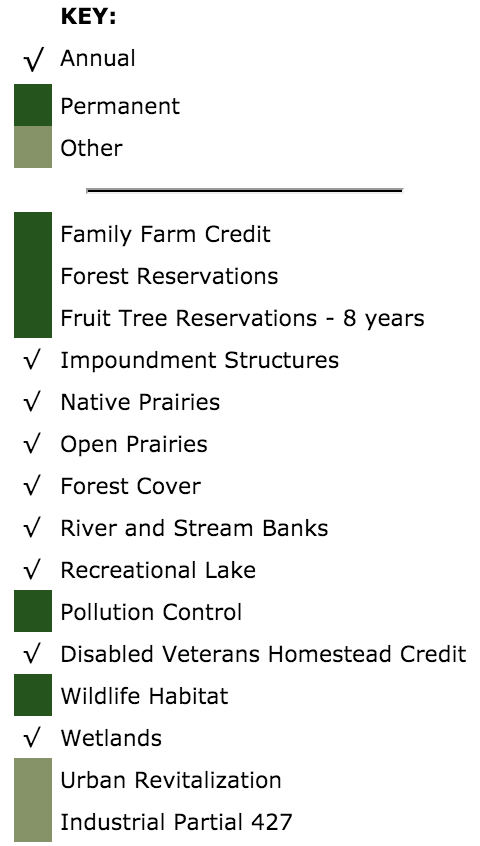

Iowa Code section 5612 defines the amount of property that qualifies for homestead treatment and these same definitions apply to the Disabled Veteran Tax Credit. 54-049a 051117 IOWA. IOWA To the Assessors Office of CountyCity Application for Homestead Tax Credit Iowa Code Section 425 This application must be filed or mailed to your city or county assessor by July 1.

Sioux City IA 51101 Iowa law provides for a number of exemptions and credits including Homestead Credit and Military Exemption. This application must be filed with your city or county assessor by July 1 of the assessment year. Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit.

This application must be filed or postmarked to your city or county assessor on or. Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit. Application for Homestead Tax Credit.

Iowa law provides for a number of credits and exemptions. The applicant must own and occupy the property on July 1 st of each year declare residency in Iowa for income tax purposes and occupy the property at least six months each year. Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801.

Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801. It is the property owners responsibility to apply for.

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

State Tax Treatment Of Homestead And Non Homestead Residential Property

Assessor Palo Alto County Iowa

An Introduction To Iowa Property Tax Story County Ia Official Website

Sioux County Treasurer Sioux County Iowa

Ashley Rance Realtor Skogman Realty Home Facebook

Everything You Need To Know About The Solar Tax Credit

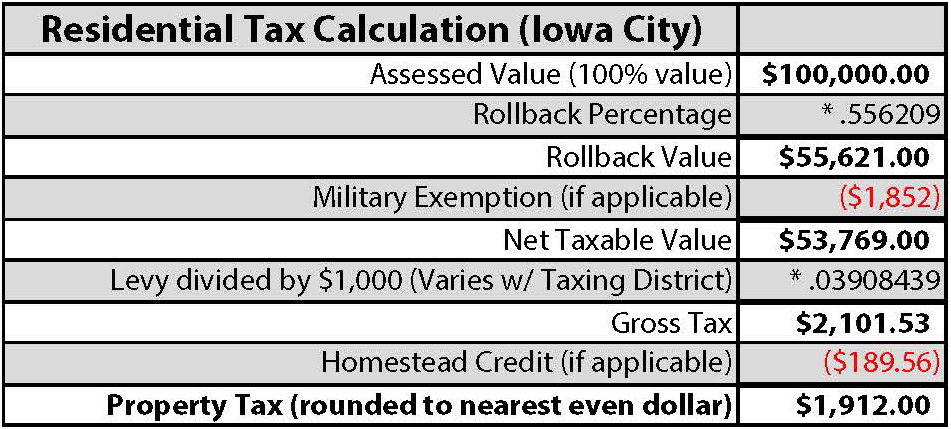

Property Tax Levies For 2019 Iowa City Real Estate Lepic Kroeger Realtors

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Homestead Tax Credit Johnson County Iowa Homestead Tax Credit Youtube

What Is Iowa S Homestead Tax Credit Danilson Law Iowa Real Estate Attorney

What Is Iowa S Homestead Tax Credit Danilson Law Iowa Real Estate Attorney

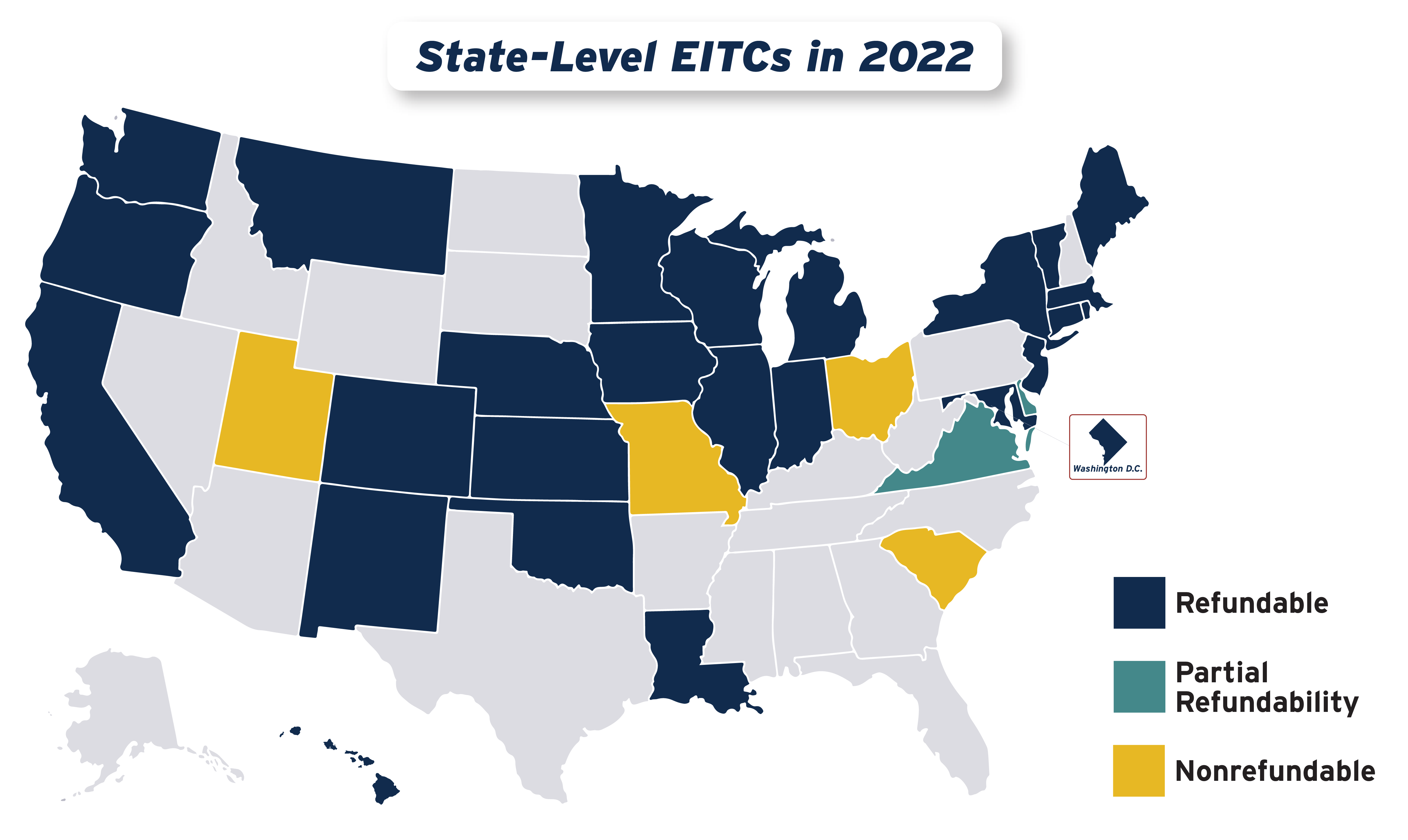

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

An Introduction To Iowa Property Tax Story County Ia Official Website

Frequently Asked Questions For The Iowa State Association Of County Auditors

What Is The Veterans Property Tax Exemption The Ascent By Motley Fool